Aaron Rezaee

FFYS 1000: Fairy Tales

Prof. Kelly Younger

17 April 2024

Unlocking the Forbidden Room: Curiosity and Risk in the Tale of Bluebeard and Behavioral

Finance

Written in 1697, “The Tale of Bluebeard” by Charles Perrault is a famous French story that employs themes of curiosity and disobedience to teach children about the dangers of the unknown. It also holds a significant place in the human psyche’s decision-making realm. Through its dark narrative, Perrault’s story serves as a powerful cautionary tale about the potential consequences of defying established norms and delving into the forbidden or the unknown. The decisions that Bluebeard’s wife makes by dwelling on the unknown and the potential of what lies behind the forbidden chamber parallels the risk and the unknowable dangers of high-risk financial investments. For this paper, I will analyze different research on behavioral finance to examine how psychological elements – mainly curiosity – influence financial market risk assessment and economic decisions. By unraveling and understanding the thought processes of Bluebeard’s wife in Perrault’s Bluebeard, behavioral finance risk analyses consider the roles of disobedience, curiosity, and greed in decision-making.

The tale opens with a rich man known in the region as Bluebeard due to his frighteningly blue-colored beard. He owns a magnificent estate that draws much attention but instills fear due to his mysterious and ominous reputation. Using his massive wealth to convince women to marry him, he has had many wives who have all gone missing with unanswered questions. His newest wife is left with his entire estate while he is away, and he has instructed one condition: not opening a specific chamber. Naturally, she is curious about what could be hidden behind this door, and “the temptation was so great she was unable to resist it” (Perrault 190). Eventually, she discovers that behind the door are the wives who have gone missing, all of them dead with their blood spilled over the floor. When Bluebeard learns of her decision to enter the chamber, he decides to kill her for violating his instruction, yet is stopped by her brother, who saves his sister’s life and ends Bluebeard’s. From the tale, we see the mistake of Bluebeard’s wife and how foolish she is for risking a peek into the forbidden. She already has all the physical wealth she needs and is undoubtedly comfortable in the castle, yet she succumbs to her curiosity and opens the door. However, it is essential to explore what drove her curiosity. Greed, lack of knowledge, and the temptation of the forbidden often make a compelling combination that overrides caution and rational decision-making. The combination of emotion and forbidden attraction can lead to catastrophic consequences, much like those faced by Bluebeard’s wife, who, despite various warnings and existing wealth, still gave into the fatal lure of the unknown. Her risk-taking behavior is mirrored in financial markets where investors, often well-situated but driven by the desire for greater returns, engage in high-risk investments without fully appreciating the potential for loss. The finance focus for the current analysis is that of larger companies making multi-million investments. On the individual level of thinking, examples from massive firms and the common trends we see within the markets will be examined.

One could argue that greed pushed Bluebeard’s wife’s decision to act as she did. Within the world of finance are those who are successful and have much but still clamor for more, and “in the domain of gains, when prior outcomes are not an issue, entrepreneurial risk managers are more prone to take risks than others” (Hersh Shefrin 383). Considering Bluebeard’s wife’s perspective, similar to an entrepreneurial risk manager who tends to have much wealth entrusted to them, taking extra risk is less of a personal worry since their job is to mediate someone else’s money. They already possess substantial resources and are often driven to pursue even more significant gains, a pursuit that can sometimes lead them to overlook or underestimate the potential risks involved. This psychological tendency to engage in riskier behaviors when one feels financially secure can mirror the actions of Bluebeard’s wife, who, despite having everything she could need, still ventured into the forbidden, driven by a mix of curiosity and perhaps greed for what else might be beyond the established boundaries. This idea is referred to as the overconfidence bias as it “typically leads people to underestimate risk, and that is perhaps the most important point about overconfidence that risk managers need to know” (Shefrin 62). Bluebeard’s wife seemed to have an overconfidence bias as she believed that whatever was behind that door was something she could handle, and she did not seem worried about the consequences. Such overconfidence bias parallels investors’ belief that their knowledge and confidence in risky decision-making will lead them to success. In both cases, the decision-makers are not worried about potentially harmful consequences. Financial confidence comes after some success in the business world; Bluebeard’s wife’s confidence comes from the riches and the magnificent life she has attained. Success often eventually involves taking on substantial risks. When comparing the overconfidence bias to how success brings greater risk, Mrs. Bluebeard’s choices seem to reflect a perfect example of how past accomplishments and security may inspire people to take on more considerable risks. In short, investors who achieve initial success may become blinded to the potential hazards of their risky financial businesses.

To blame Bluebeard’s wife for her assumed greed and her curiosity for the unknown is what the original tale aims to warn against. Yet, the role of fear and anxiety never seemed to be blamed. To give her the benefit of the doubt, even though her decision was not rash, her fear is sensible as three of his wives have gone missing. The curiosity about the unknown could have been aimed at the fact that she feared what she would find, including the possibility of finding something gruesome and the real threat that Bluebeard himself posed. She may have assumed that she would be better prepared for what lay beyond that door by discovering the truth and entering the forbidden chamber, being able to defend herself from what Bluebeard had hidden behind this chamber. Her combined fear and anxiety could be the alternative answer to her lapse in judgment so as not to blame her decision on greed, offering a multifaceted response to a profoundly threatening situation. This variation of understanding Bluebeard’s wife’s motivations can be applied to panic selling at both the individual and the institutional level. The leading cause of panic selling is the fear of losing more during a financial downturn, prompting investors to sell off their holdings prematurely. Driven by the fear of losing money, the reaction parallels the fear experienced by Bluebeard’s wife. In financial markets, panic selling is often observed as “exiting the stock market in sudden panic or buying a hot stock on the basis of enthusiasm rather than critical evaluation,” as David Hirshleifer notes in behavioral finance research (Hirshleifer 136). Just as fear and anxiety lured Bluebeard’s wife to explore the forbidden chamber in hopes of protecting her future, investors with the same fear and anxiety are pushed in a way that makes their decision-making counterproductive.

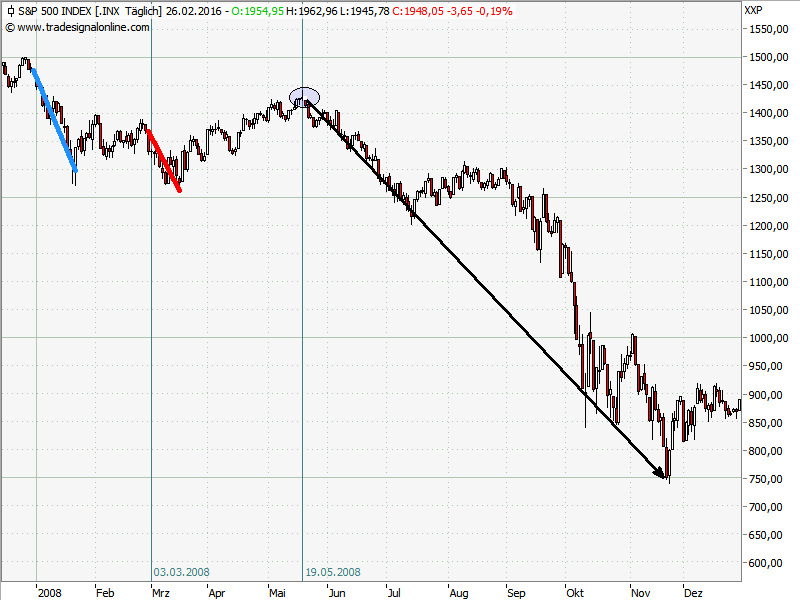

In 2008, a substantial financial crisis hit the market, causing a worldwide economic collapse. The financial crisis happened when a housing market crash led many people to default on their home loans, resulting in foreclosures and decreased value of housing investments.

The above image shows the S&P 500, an index of the 500 largest companies in the world. The S&P 500 is generally used to measure market health in a broad spectrum. We follow the black line, which shows an intense decrease in the S&P 500 from May to December. This line represents the market reaction to the housing crisis and the ensuing financial instability and uncertainty that characterized this period for millions worldwide impacted. The blue and red lines are referred to as the bearish trends. What those lines represent suggests that the market’s movement at small periods of time showed negative price changes, which dictated selling pressure and led to falling prices. As fear and anxiety spread throughout communities globally, they often led to dramatic measures, just as Bluebeard’s wife felt forced to open the forbidden door despite understanding the risk. Marked by fear and the drive for self-preservation, this human response to disaster is similar to the desperate acts of individuals and institutions during the financial meltdown. Markets collapsed, taking with them the livelihoods of people who acted in panic, selling off assets to safeguard their financial futures, reflecting Bluebeard’s wife’s frantic fight for safety. Reactions to sudden changes with negative impacts lead to panicked decision-making, underscoring the critical role of psychological resilience and working to make informed judgments during times of struggle. Bluebeard’s wife, for her part, may have profited from wisdom and restraint. Still, the lesson for the modern financial world is clear: the significance of remaining calm and knowledgeable during economic downturns cannot be overemphasized. Looking toward Bluebeard’s wife’s reaction to the situation, she tried to cover up her mistake and avoid seemingly evitable death. Yet, she tapped into psychological resilience while waiting for her brothers. Daniel Kahneman explains the basis of such resilience, stating, “Resilience to setbacks is enhanced by an optimistic explanatory style; optimistic individuals take credit for successes and explain away their failures, and this skill is partly trainable” (Kahneman 250). Mrs. Bluebeard’s optimism enhances resilience and can be developed as a skill vital in both personal crises and financial turmoil.

In the end, Charles Perrault’s “The Tale of Bluebeard” is a work of fiction that offers profound insight into the nature of human behavior. This famous French tale shared with many children showed the dangers of curiosity and the power of the unknown in a simple manner, yet the depth of the story continues so much more. The behavioral finance explored in this paper investigates how psychological factors – curiosity and fear – influence financial market risk assessment and economic actions. Behavioral finance risk assessments examine the roles of disobedience, curiosity, and greed in decision-making by unraveling and comprehending the mental processes of Bluebeard’s wife in Perrault’s Cautionary Tale. The story’s themes closely align with key aspects of behavioral finance and explore the psychological dynamics driving financial decision-making. These themes closely compare to phenomena in the 2008 economic meltdown. Finally, the lessons learned from Bluebeard’s narrative are not only academic; they apply directly to our knowledge and interaction with financial markets. This multifaceted study broadens the scope of literary themes and provides practical insights for navigating today’s complex financial markets.

Works Cited

Hirshleifer, David. “Behavioral Finance.” Annual Review of Financial Economics, vol. 7, 2015, pp. 133–59. JSTOR, http://www.jstor.org/stable/44864033. Accessed 14 Apr. 2024.

Kahneman, Daniel. Thinking, Fast and Slow. Farrar, Straus and Giroux, 2013.

Lerner, Jennifer S., et al. “Emotion and Decision Making.” Annual Review of Psychology, vol. 66, 2015, pp. 799–823. Annual Reviews, doi:10.1146/annurev-psych-010213-115043.

Shefrin, Hersh. Behavioral Risk Management: Managing the Psychology That Drives Decisions and Influences Operational Risk. Palgrave Macmillan, 2016. Accessed 14 April 2024.